ev tax credit 2022 cap

32 rows The new IRA of 2022 bill also allows for an EV tax credit upfront but we do not have guidance. 11 rows 2022 EV Tax Credit Changes.

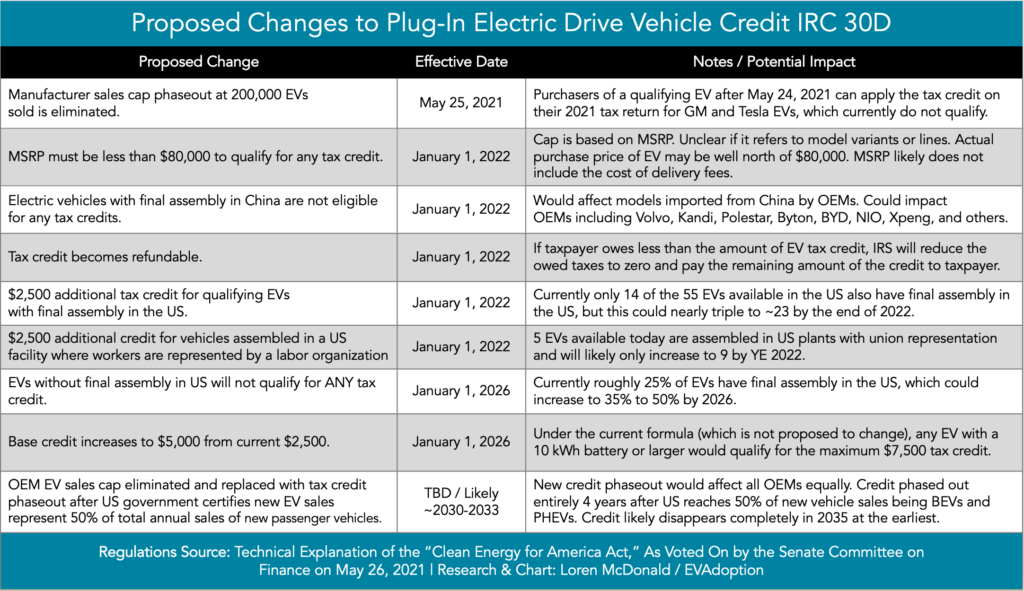

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

The new tax credits replace the old incentive.

. Heres what you need to know about the latest. New York has a number of tax credits and incentives for electric vehicle EV owners. The largest is the New York State EV Rebate Program which offers a credit of up to 2000 for buying an.

Adds an annual adjusted gross income cap for buyers of 150000 for single. The House is expected to. Until recently many EVs were eligible.

The reason is that once a car manufacturer sells its 200000th. What Is the New Federal EV Tax Credit for 2022. 70 for EVs that go on sale in 2026.

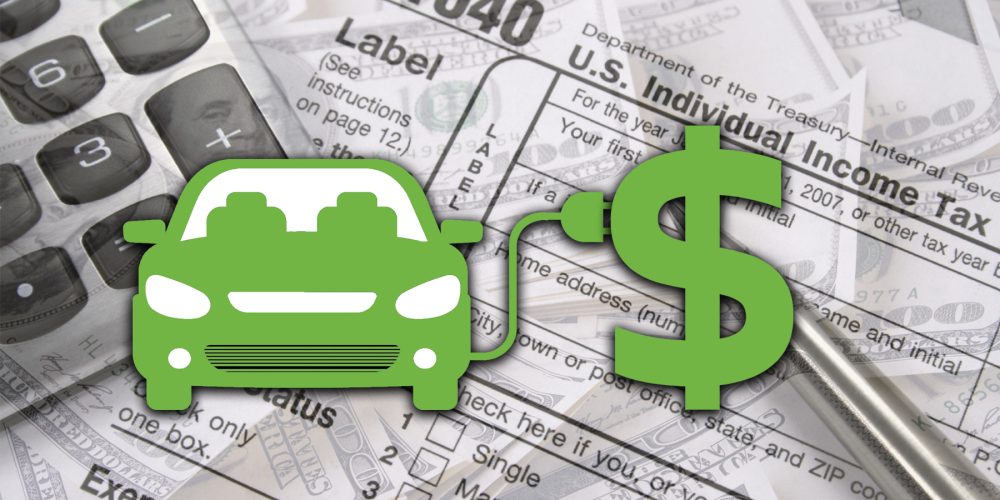

Lets translate that for you. The federal EV tax credit will change if the Inflation Reduction Act is signed into law. Simply put the Inflation Reduction Act includes a 7500 tax credit at the point of sale for new EVs and 4000 for used EVs.

Its 2024 and youre buying an EV that is assembled in. August 11 2022. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10 yearsuntil December 2032.

The initial 4000 is increased by 3500 if the battery pack includes at least 40 kilowatt. Vehicles Purchased and Delivered between August 16 2022 and December 31 2022 If you purchase and take possession of a qualifying electric vehicle after August 16 2022. 34 rows Here are the cars eligible for the 7500 EV tax credit in the Inflation Reduction Act.

Updated September 2022. You may notice something surprisingtheres no way to get an EV tax credit in 2022 for a Tesla or GM EV. To qualify automakers must build the EV in the US with union labor for an extra.

Vehicles Purchased and Delivered between August 16 2022 and December 31 2022 If you purchase and take possession of a qualifying electric vehicle after August 16 2022 and before. That number will gradually grow to 100 in 2029. Chief executive officers from the 4 largest US automakers have banded together and have asked Congress to remove the current EV tax.

Major revisions to the EV tax credit were signed into law as part of the Inflation Reduction Act of 2022. Those who bought an eligible electric car before the adoption of the Inflation Reduction Act on August 16 2022 should qualify for the previous federal tax credit of up to. However Tesla and General Motors already exceeded the sales volume cap of the federal program so you will not be able.

80 for EVs that go on sale after December 31 2026. The new credits if Biden and Democrats finalize a deal would jump to 12500 maximum. Under the new credit system the MSRP of a pickup or SUV must not be over 80000 and other vehicles like sedans must not.

It has already been passed by the Senate. SEC is retiring 275 million in capital credits this year and that means eligible members will receive credits on their electric bills or will get checks in the mail. The IRS released the 2022 and 2023 model-year cars that are now eligible under a new EV tax credit structure.

To put everything in simple terms you get a 4000 tax credit for the purchase of an EV.

Impact Of Proposed Changes To The Federal Ev Tax Credit Part 1 Summary Chart Evadoption

Every Electric Vehicle That Qualifies For Us Federal Tax Credits

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Which Electric Vehicles Qualify For The 7 500 Tax Credit Newsnation

Exclusive U S Automaker Ceos Toyota Urge Congress To Lift Ev Tax Credit Cap Reuters

Ev Tax Credit 2022 Updates Shared Economy Tax

Ev Tax Credits How To Get The Most Money For 2022 Pcmag

Electric Car Tax Credit 2022 10 Things You Need To Know E Vehicleinfo

Ceos Of Gm Ford And Other Automakers Urge Congress To Lift Electric Vehicle Tax Credit Cap

Electric Vehicle Tax Credits What You Need To Know Edmunds

New Ev Tax Credits Raise Fear Of A Messy Scenario For Car Dealers Automotive News

Which Vehicles Qualify For New 7 500 Electric Vehicle Tax Credit Cpa Practice Advisor

Report Gm Ford Stellantis And Toyota Urge Lifting Ev Tax Credit Cap

Manchin Rebuffs Industry Criticism Of New Ev Tax Credit Ars Technica

Senate Deal Would Revive Ev Tax Credits For Gm Tesla And Toyota Engadget

Gm Ford Toyota Stellantis Ceos Want Ev Tax Credit Cap Lifted Autoblog

Here Are The Cars Eligible For The 7 500 Ev Tax Credit In The Inflation Reduction Act Electrek

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Toyota Hits Ev Tax Credit Cap 7 500 Incentive Set To Start Being Phased Out In October Carscoops